Tax Blog

Tips to help you prepare for tax season

Want Faster Filing and Rapid Refunds? Go Digital

Filing season is finally here and for many tax professionals, the watchwords are speed and accuracy. The Internal Revenue Service says it can help with both.… Read more about Want Faster Filing and Rapid Refunds? Go Digital (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Gathering Records Is the First Step in Tax Preparation

It won’t be long before the Internal Revenue Service opens its gates and the filing season will be officially underway.… Read more about Gathering Records Is the First Step in Tax Preparation (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Unveils New Self-Employed Sick Leave and Family Leave Form

Taxpayers may be aware that the Families First Coronavirus Response Act (FFCRA) includes a refundable tax credit for eligible employers who provide COVID-related sick and family leave. What some might not know is that this credit is also available for self-employed individuals, and a new form from the Internal Revenue Service makes claiming it straightforward.… Read more about IRS Unveils New Self-Employed Sick Leave and Family Leave Form (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Warns About Preparers Who Don’t Sign Their Works

The Internal Revenue Service is reminding taxpayers that the best tax professionals are those who always sign the returns they’ve prepared.… Read more about IRS Warns About Preparers Who Don’t Sign Their Works (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Educators Can Now Deduct Expenses for COVID-19 PPE

Since the Coronavirus pandemic began, we’ve heard a lot about front-line health care workers and their risks. Now we’ve come to know that teachers face risks of their own.… Read more about Educators Can Now Deduct Expenses for COVID-19 PPE (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

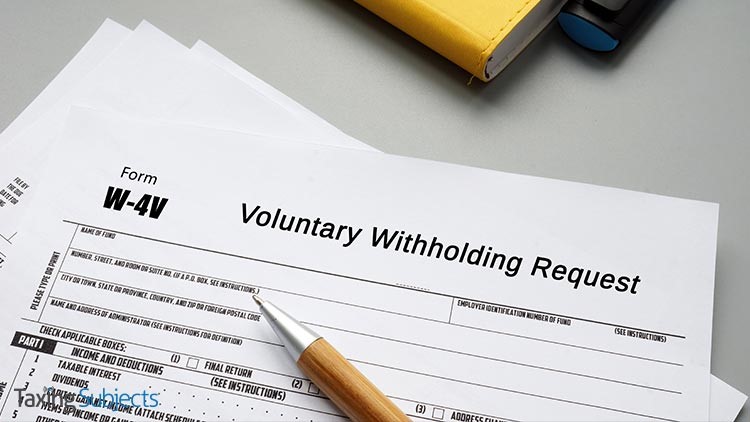

Unemployment Recipients May Not Know Their Benefits Are Taxable

The Department of Labor reported a staggering 75.9 million initial unemployment insurance benefits claims from January 5, 2020 to January 2, 2021. The number of weekly claims spiked in March, underscoring the devastating financial impact of the COVID-19 pandemic and creating millions of first-time unemployment recipients who might not realize that those benefits are taxable.… Read more about Unemployment Recipients May Not Know Their Benefits Are Taxable (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Address

438 Amapola Avenue Suite 210

Torrance, CA 90501